First paycheck calculator

Paycheck Calculator ADDALLOW CAT DCA1 DCA2 DCA3 DCA4 DCA5 DCA6 DED1 DED3 DED4 EPMC EPMC_ EPMC2. Youll see what your wage amounts to when stated as each of the common periodic terms.

Paycheck Calculator Online For Per Pay Period Create W 4

The calculator will also provide your FIRE age which is the age when you can expect to achieve FIRE and be able to retire.

. Federal state liability or refunds. Feel free to run different scenarios through the calculator. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Results of the calculator are. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Florida residents only.

Federal Paycheck Calculator Calculate your take home pay after federal state local taxes. First you need to determine your filing status to understand your tax bracket. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs.

2022 Salary Paycheck Calculator Usage Instructions. First enter the dollar amount of the wage you wish to convert as well as the period of time that the wage represents. If your monthly paycheck is 6000 372 goes to Social.

There are 4 main filing statuses. Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Enter the number of hours you work a week and click on Convert Wage.

Register to save paychecks and manage payroll the first 3 months are free. Texas Hourly Paycheck and Payroll Calculator. Results are based on 2022-23 Cost of Attendance figures and student aid eligibility requirements.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers. Future costs and financial aid estimates are subject to change. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

- 513 to apply appropriately. Peach State residents who make more money can. Now you can easily create a Form W-4 that reflects your planned tax withholding amount.

Bereas Cost Estimator was developed to help you and your family estimate your first-year costs. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Texas. Need help calculating paychecks.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Then enter the employees gross salary amount. It is not a substitute for the advice of an accountant or other tax professional.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. You may find youll need to contribute more money to your investment and retirement accounts or experiment with different rates of return to meet your goals. 2020 Earnings Statements or 2020 Paycheck Stubs.

Pay frequency File status. Exempt means the employee does not receive overtime pay. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you.

It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck recalculate monthly wage to hourly rate weekly rate to a yearly wage etc. Overview of Georgia Taxes. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major change since 1987.

If the full amount of the retirement exclusion was not applied to the first half payment you should not when an employee will not receive pay in the 1st half enter 1 in B6 to allow the retirement exclusion eg. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Salary to hourly wage calculator lets you see how much you earn over different periods.

2021 2022 Paycheck and W-4 Check Calculator. This salary converter does it all very quickly and easily saving you time and effort. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Your job income salary year. Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575.

Step 1 Filing status.

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

12 Salary Paycheck Calculator Templates Free Pdf Doc Excel Formats

Paycheck Calculator Take Home Pay Calculator

Free Paycheck Calculator Hourly Salary Usa Dremployee

Gross Pay And Net Pay What S The Difference Paycheckcity

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

Hourly Paycheck Calculator Step By Step With Examples

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

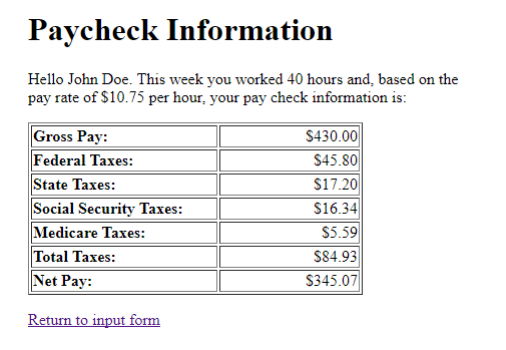

Solved Paycheck Calculator In This Assignment You Need To Chegg Com